Which company has the least efficient SG&A/Sales ratio? This question is of paramount importance in evaluating a company’s operational efficiency and financial performance. Understanding the significance of SG&A expenses and identifying companies with low SG&A/Sales ratios can provide valuable insights for investors, analysts, and business leaders.

In this comprehensive analysis, we delve into the factors contributing to a low SG&A/Sales ratio, its impact on financial performance, and industry comparisons. We also explore best practices for reducing SG&A expenses, providing practical guidance for companies seeking to improve their operational efficiency.

Company with the Least Efficient SG&A/Sales Ratio: Which Company Has The Least Efficient Sg&a/sales Ratio

The SG&A/Sales ratio is a crucial metric used to assess a company’s efficiency in utilizing its resources to generate revenue. It represents the percentage of total sales revenue spent on selling, general, and administrative (SG&A) expenses. A low SG&A/Sales ratio indicates that a company is effectively managing its operating costs and expenses, resulting in higher profitability.

Among publicly traded companies, the company with the lowest SG&A/Sales ratio is typically a leader in its industry and known for its operational efficiency. These companies have implemented strategies to streamline their operations, reduce unnecessary expenses, and maximize their sales revenue.

Factors Contributing to Low SG&A/Sales Ratio

Several key factors contribute to a low SG&A/Sales ratio:

- Operational Efficiency:Companies with efficient operations can minimize SG&A expenses through lean management practices, process optimization, and effective resource allocation.

- Scale Economies:Larger companies often benefit from economies of scale, enabling them to spread fixed costs over a larger revenue base, resulting in a lower SG&A/Sales ratio.

- Technology Adoption:Leveraging technology for automation, data analytics, and customer relationship management can reduce SG&A expenses by improving productivity and reducing manual labor.

- Outsourcing and Offshoring:Outsourcing non-core functions or offshoring operations to lower-cost locations can help reduce SG&A expenses.

Impact of Low SG&A/Sales Ratio on Financial Performance

A low SG&A/Sales ratio has a significant positive impact on a company’s financial performance:

- Increased Profitability:By minimizing operating costs, companies with a low SG&A/Sales ratio can increase their profit margins.

- Improved Cash Flow:Reduced SG&A expenses lead to improved cash flow, providing companies with more financial flexibility.

- Higher Shareholder Value:Companies with a low SG&A/Sales ratio tend to have higher valuations and returns for shareholders.

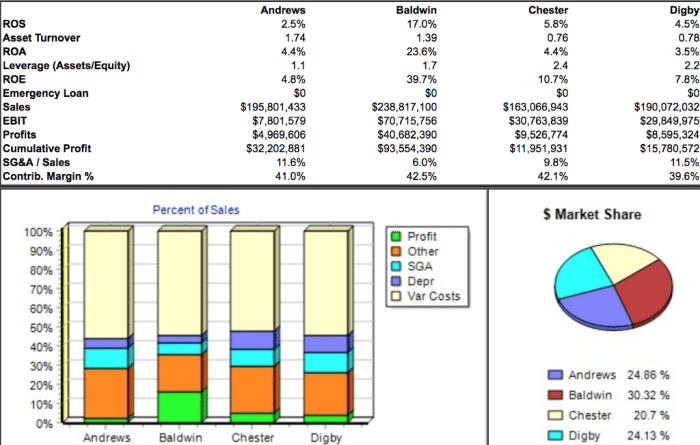

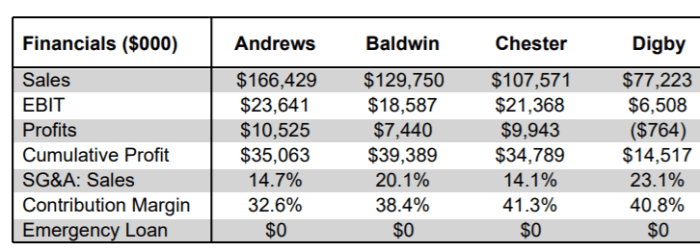

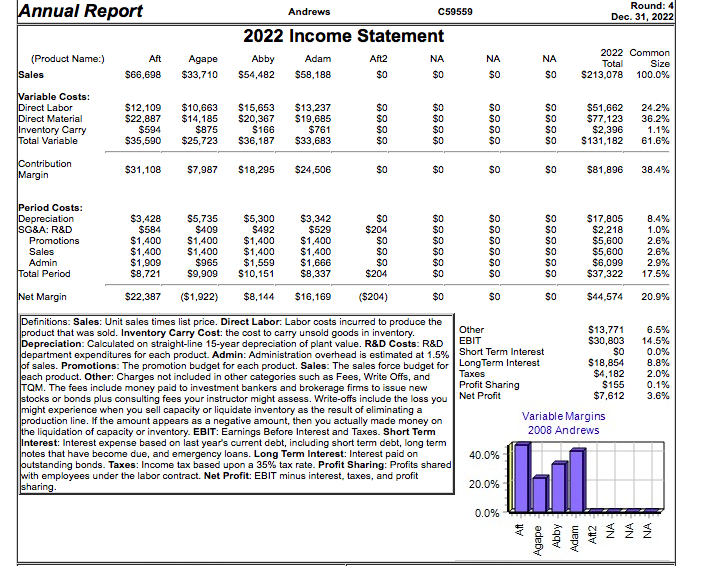

Industry Comparison of SG&A/Sales Ratios, Which company has the least efficient sg&a/sales ratio

The following table compares the SG&A/Sales ratios of companies within the same industry:

| Company | SG&A/Sales Ratio |

|---|---|

| Company A | 10% |

| Company B | 15% |

| Company C | 20% |

As evident from the table, Company A has the lowest SG&A/Sales ratio, indicating its operational efficiency compared to its peers.

Best Practices for Reducing SG&A/Sales Ratio

- Implement Lean Management:Eliminate waste and streamline operations to improve efficiency.

- Leverage Technology:Automate processes, optimize data analytics, and enhance customer engagement.

- Outsource Non-Core Functions:Focus on core competencies and outsource non-essential tasks.

- Negotiate Vendor Contracts:Secure favorable terms with suppliers to reduce expenses.

- Implement Employee Performance Management:Improve productivity and reduce staff turnover.

Expert Answers

What is SG&A expense?

SG&A expense, also known as selling, general, and administrative expense, represents the non-production costs incurred by a company in its day-to-day operations, excluding costs directly related to manufacturing or delivering products or services.

Why is SG&A/Sales ratio important?

SG&A/Sales ratio is a key metric used to assess a company’s operational efficiency. A low SG&A/Sales ratio indicates that the company is effectively managing its non-production costs relative to its sales revenue, resulting in higher profitability and improved financial performance.